While US stocks were moving higher in light of tax cut this month, local stocks didn't seem to have the same sentiment. Up till today, STI lose 47.83 points, or 1.39% this month. Since everyone is preparing to enjoy the well deserved year end break, I don't think much will happen next week. (personal opinion, don't hold me for it)

Compared to the index, my portfolio did better this month. Its value dropped only 0.4% compared with end November.

This month, CWT finally was de-listed. I bought it at 95 cents years ago and now sold it at S$2.33. So it was not so bad. No other transaction was done.

For the year 2017, Singapore share market has done well. The STI index gained 504.95 points, or 17.53% for the whole year. My portfolio did not perform as well. Its value rose only 10.41% for the year. That was due to poor performance of some heavy weights in it, e.g. SPH, Comfortdelgro, M1 etc. Net cash flow into the portfolio (fresh fund invested) this year was S$188,000.

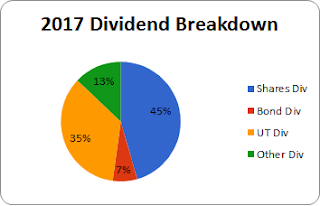

Total dividend received this month was S$14,000, from stocks, bonds and UT. The full year passive income amounts to S$178,000, surpassing that from last year and exceeded my target. I have invested in a small business run by a friend and the dividend which I was supposed to receive last year was only received in January this year. If we shift the dividend to last year, then total passive income received this year would be almost the same as last year. All in all, dividend from shares has decreased this year but was compensated by dividend from bonds and UT's.

Below are my top 30 holdings as at 22 December 2017.

1.

M1

2.

DBS

3.

OCBC Bank

4.

SPH

5.

Ausnet Services

6.

ComfortDelGro

7.

Metro

8.

CapitaComm Tr

9.

Kep Inf Tr fKa CIT

10.

Frasers Comm Tr

11.

ST Engineering

12.

Keppel Corp

13.

SGX

14.

SATS

15.

Sembcorp Ind

16.

AIMSAMP Cap Reit

17.

CapitaLand

18.

Starhub

19.

Sing Inv & Fin

20.

Mapletree Log Tr

21.

Global Inv

22.

Tai Sin Electric

23.

Cache Log Trust

24.

Lippo Malls Tr

25.

Nam Lee Metal

26.

YZJ Shipbldg SGD

27.

Ascendas Reit

28.

United Engineers

29.

Lian Beng

30.

Nikko AM STI ETF 100

8 comments:

Hi Sanye,

Is the $178k dividend income only? How do you account for your profit/losses in your share transactions?

Thanks.

Hi K,

Yes, $178K is pure dividend income. I don't really have very accurate account on profit/losses in share transactions, since I don't do many transactions/tradings. I do keep a record on total gain/loss of my share portfolio, but this is also not an accurate record.My focus is on dividend.

Impressive. Do you keep emergency funds? In other words, are you 100% invested in equities, bonds and unit trusts?

LKH,

I don't keep an emergency fund as cash, but my CPF OA is treated as my emergency fund as I am able to withdraw it as and when I need it.

There is also a cash portion in my portfolio (which I don't normally report on it) to provide me with some sort of reserve.

Hi sanye

What do you think of sph? Is it still worth to hold it? Its depreciated a lot.

Also what do you think of sia eng? Still worth h buying?

Hi Mei Ling,

Thanks for visiting my blog.

SPH has bottomed in my opinion. If you had intention to cut loss it should have been done earlier. At this juncture I am holding my SPH shares. It will take some time to recover. Meanwhile just continue to collect dividend.

SIA Engineering is also in my Long term portfolio. I am not buying it but will hold it.

Just my own opinion.

I'm curious to find out what blog system you're utilizing? I'm experiencing some small security problems with my latest website and I would like to find something more safeguarded. Do you have any recommendations? fonds indien

Post a Comment